Summary

- London remains at the heart of the UK’s surge in new business formations: roughly 280,000 incorporations happened in London boroughs in 2024 alone.

- Meanwhile, prime office rents are climbing.

- For instance central London headline rents rose by 7% in Q1 2025 and availability is tightening.

- For entrepreneurs in retail, hospitality or general startups, choosing the right postcode can mean lower setup costs, higher footfall and better growth potential.

- In this guide, we present our vetted list of the best London postcodes for startups and assess each via our LBND Startup Potential Score to help you make an informed choice.

London’s postcode system is also a proxy map of business opportunity.

From retail and hospitality to tech startups and creative ventures, the right postcode can shape your costs, your customer base, and your growth.

But with dozens of vibrant districts and ever-changing trends, it’s not easy to spot the most promising areas (especially if you’re new to the city’s business landscape).

- Some postcodes are retail magnets with bustling footfall

- Others attract hospitality and creative startups with affordable workspace

- Many mix talent, funding, and lifestyle appeal in ways you might not expect

So where should you start your business for the best shot at success?

Our guide reveals the best London postcodes for startups in 2026, which we have chosen for their blend of affordability, growth, and practical advantages.

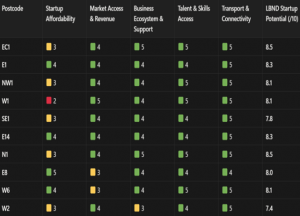

How We Rated Each Postcode: The LBND Potential Score

To make this shortlist, we’ve developed the LBND Potential Score, which is a clear, evidence-based way to compare each postcode’s opportunity for new businesses. We rate each contender on five weighted factors:

- Startup Affordability (25%)

- Market Access & Revenue Potential (25%)

- Business Ecosystem & Support (20%)

- Talent & Skills Access (15%)

- Transport & Connectivity (15%)

Each factor is scored out of 5, then weighted and combined for a final score out of 10. This makes it easy to see which postcodes offer the strongest startup potential right now.

Also read: Our 10 Most Popular London Boroughs and Businesses

Disclaimer: All information in this guide was correct at the time of publication but may be subject to change.

1. EC1 (Old Street/Tech City) — LBND Startup Potential Score: 8.5/10

Old Street’s EC1 remains the engine room of London’s digital economy. Over 2,000 startups call it home, which makes it the ultimate launchpad for tech, digital, and scale-up ventures.

- Location/Key Area: Old Street, Clerkenwell, Farringdon

- Typical Workspace Costs: £25–£40 per sq ft (mid-range for central)

- Startup Scene: Tech, fintech, SaaS, digital marketing, VCs on your doorstep

- Access & Transport: Old Street, Farringdon, Liverpool Street (multiple Tube/rail lines)

- Best For: Tech founders, fast-scaling digital agencies, SaaS, fintech

- What Sets It Apart: Global tech hub, dense VC/investor presence, and fast-growth scaleups.

- Population & Local Workforce: Approx. 41,200 residents; strong young professional pool, with a high density of digital talent*.

2. E1 (Shoreditch/Brick Lane) — LBND Startup Potential Score: 8.3/10

Shoreditch’s E1 mixes creative flair with serious commercial edge. Startups are drawn by edgy branding, lively nightlife, and a culture that values originality. It’s a hotspot for creative industries, D2C brands, and digital disruptors.

- Location/Key Area: Shoreditch, Spitalfields, Brick Lane

- Typical Workspace Costs: £30–£45 per sq ft (cheaper than West End)

- Startup Scene: Creative, fashion-tech, digital media, pop-ups, galleries

- Access & Transport: Shoreditch High Street, Liverpool Street, Aldgate East

- Best For: Creative startups, design, media, indie retail

- What Sets It Apart: Creative energy, independent retail, nightlife, and trendsetting startup culture.

- Population & Local Workforce: Around 653,000 people; among London’s highest densities (16,663/km²)*.

3. NW1 (Camden Town/King’s Cross) — LBND Startup Potential Score: 8.1/10

NW1 blends creative freedom with King’s Cross’s rapid growth. Camden’s markets pulse with B2C startups and subcultures, while King’s Cross is a tech and AI magnet. The area is perfect for startups that need to tap student talent and want quick connections to all of London.

- Location/Key Area: Camden Town, King’s Cross, Regent’s Canal

- Typical Workspace Costs: £45–£60 per sq ft (lower than Soho)

- Startup Scene: AI, creative, e-commerce, food, music, student-driven brands

- Access & Transport: King’s Cross St Pancras, Camden Town, Euston

- Best For: Tech, AI, creative, e-commerce, music/entertainment

- What Sets It Apart: Student talent, diverse markets, AI/tech cluster, and excellent cross-London links.

- Population & Local Workforce: Population of 184,500; diverse mix, large student presence, and excellent access to talent*.

4. W1 (Soho/Fitzrovia/West End) — LBND Startup Potential Score: 8.1/10

W1 is the heart of London’s creative and consumer power. Soho’s world-famous media history now attracts high-end startups and creative agencies. Footfall and consumer spend are massive, but so are the rents, so this is a postcode for businesses with a budget and a bold brand.

- Location/Key Area: Soho, Fitzrovia, Oxford Street, West End

- Typical Workspace Costs: £95–£115 per sq ft (premium)

- Startup Scene: Creative agencies, digital, luxury retail, media, B2C

- Access & Transport: Oxford Circus, Tottenham Court Road, Bond Street

- Best For: Media, luxury, creative agencies, well-funded B2C brands

- What Sets It Apart: Prestige address, huge consumer footfall, creative/media industries, and high-spend clientele.

- Population & Local Workforce: 208,300 residents; central location with a high daytime working population*.

5. SE1 (South Bank/London Bridge/Borough) — LBND Startup Potential Score: 7.8/10

SE1 offers a vibrant mix of culture and commerce, with Borough Market and the South Bank drawing constant crowds. Lower rents than the City but just as well connected, SE1 suits startups needing a central base, food/drink visibility, or strong B2B/B2C access.

- Location/Key Area: South Bank, Borough, London Bridge, Waterloo

- Typical Workspace Costs: £75–£90 per sq ft (lower than City/West End)

- Startup Scene: Food & drink, marketing, events, media, design

- Access & Transport: London Bridge, Waterloo, Blackfriars

- Best For: Food/drink, events, creative, marketing, B2B/B2C

- What Sets It Apart: Cultural hotspots, strong B2B/B2C mix, affordable central rents, and lifestyle appeal.

- Population & Local Workforce: Over 508,000 residents; 13,979/km² density ensures busy footfall*.

6. E14 (Canary Wharf/Isle of Dogs) — LBND Startup Potential Score: 8.3/10

Canary Wharf is evolving from pure finance to a magnet for fintech and life sciences. Modern workspace, riverside lifestyle, and excellent transport are offset by a more corporate vibe. It’s a smart pick for B2B startups and founders looking to connect with global firms.

- Location/Key Area: Canary Wharf, Isle of Dogs

- Typical Workspace Costs: £50–£60 per sq ft (modern office stock)

- Startup Scene: Fintech, B2B, biotech, consulting, global networks

- Access & Transport: Canary Wharf (Jubilee, DLR, Elizabeth Line)

- Best For: Fintech, B2B, health/biotech, scale-ups needing corporate links

- What Sets It Apart: Financial giants, modern workspace, thriving fintech and life sciences, international connectivity.

- Population & Local Workforce: 108,200 residents, 15,810/km² density; major business hub with strong professional workforce*.

7. N1 (Islington/Angel/King’s Cross fringe) — LBND Startup Potential Score: 8.5/10

N1 is a tech and creative sweet spot, with Islington’s lively high street, Angel’s startup culture, and King’s Cross’s global tech giants. It combines affordability (compared to Soho) with direct access to top graduate talent and social buzz.

- Location/Key Area: Islington, Angel, fringe of King’s Cross

- Typical Workspace Costs: £85–£95 per sq ft (King’s Cross premium; Angel less)

- Startup Scene: Tech, SaaS, creative, social impact, networking events

- Access & Transport: Angel, King’s Cross St Pancras, Highbury & Islington

- Best For: Tech, SaaS, creative, social impact, networking

- What Sets It Apart: Tech giants, vibrant networking scene, social impact startups, and young, skilled workforce.

- Population & Local Workforce: 506,000+ residents; high density (15,087/km²), young and educated*.

8. E8 (Hackney Central/Hoxton) — LBND Startup Potential Score: 8/10

E8’s Hackney is where creative startups find space to experiment. Rents are low, culture is high, and a DIY, maker attitude prevails. It’s ideal for early-stage startups, creative projects, and those wanting a strong community vibe and affordable workspace.

- Location/Key Area: Hackney Central, Hoxton, Dalston

- Typical Workspace Costs: £35–£42 per sq ft (affordable)

- Startup Scene: Creative tech, social enterprise, arts, food, music, makerspaces

- Access & Transport: Hackney Central, Hoxton, Overground

- Best For: Creative tech, social enterprise, early-stage, food/music

- What Sets It Apart: Maker culture, affordable space, grassroots creative community, and arts-driven innovation.

- Population & Local Workforce: 42,300 people; very high density (16,594/km²), ideal for creative recruitment and local business footfall*.

9. W6 (Hammersmith/White City) — LBND Startup Potential Score: 8.1/10

W6 combines riverside living, media history (BBC/Sky), and the White City Innovation District for startups in media, tech, and biotech. With moderate rents and brilliant transport, it’s a west London base that blends lifestyle, talent, and business support.

- Location/Key Area: Hammersmith, White City, Shepherd’s Bush

- Typical Workspace Costs: £55–£65 per sq ft (moderate)

- Startup Scene: Media, tech, biotech, creative, e-commerce

- Access & Transport: Hammersmith, White City, Shepherd’s Bush

- Best For: Media, tech, biotech, creative, e-commerce

- What Sets It Apart: Media legacy, innovation district, riverside lifestyle, and rich science/tech partnerships.

- Population & Local Workforce: 36,300 residents; 13,526/km² density, with a mix of creative, science, and corporate talent*.

10. W2 (Paddington/Bayswater) — LBND Startup Potential Score: 7.4/10

W2 leverages Paddington’s transport links and office development boom. While rents are lower than the West End, the area is gaining steam with startups (especially those who value Heathrow access, centrality, and a cosmopolitan crowd).

- Location/Key Area: Paddington, Bayswater, Lancaster Gate

- Typical Workspace Costs: £80–£90 per sq ft (less than Soho)

- Startup Scene: Fintech, consumer tech, travel, meetups

- Access & Transport: Paddington (Elizabeth, mainline, Heathrow Express), Bayswater

- Best For: Fintech, consumer tech, travel, international business

- What Sets It Apart: Transport hub, new office development, international reach, and rising startup ecosystem.

- Population & Local Workforce: 44,650 people; 14,308/km² density and highly cosmopolitan*.

Whether you’re launching a hospitality venue, retail shop or tech service, location matters. Use this list of top London postcodes to hone in on your start‑up base, check current local costs, and act quickly.

Know another great London postcode for startups? Think we should feature it here? Get in touch as we’re always updating our shortlist.

Frequently Asked Questions

1. What are the best London postcodes for startups in retail and hospitality?

The best London postcodes for startups in retail and hospitality are SE1 (South Bank) for tourism and arts, E1 (Shoreditch) for independent shops and eateries, and W1 (Soho) for high-end retail and hospitality.

2. Is London a good place to launch a startup in 2026?

Yes. London consistently ranks as the UK’s top city for new business formation, with around 280,000 new companies founded in 2024.

3. What postcode is best for a tech or digital startup in London?

For tech and digital startups, EC1 (Old Street/“Silicon Roundabout”) is the best London postcode. It’s internationally recognised for its density of software, fintech, and digital businesses.

*source: https://www.postcodearea.co.uk/

Passionate reporter and editor for the LBN Directory, sharing the latest London business news, trends, insights and more.